Inland Revenue have recently announced this year’s livestock Herd Scheme Values and we think this is a great opportunity to update you on the latest movements. The Herd Scheme Values are the National Average Market Values as determined by a process involving a review of the livestock market as at 30 April.

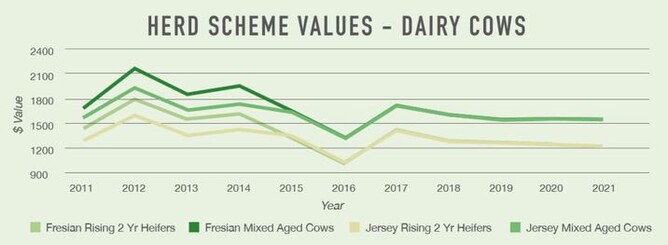

DAIRY CATTLE

The values for Dairy this year are again a mixed bag, with some values increasing against the general trend of decreases. The overall values for dairy have not had the same recovery as sheep and beef values from last year’s drops, which perhaps is a consequence of tougher environmental challenges for dairy farming as compared to sheep and beef. The drop in value for R1 heifers is likely due to the prohibition of live animal exports from 2023. Values are likely to fall in future years as the full effect of the ban flows through to values.

A Mixed Age Dairy cow now has a National Average Market Value of $1,528 compared to $1,525 last year – a rise of 0.2%. Rising two-year heifers have recovered from last year’s drop in value increasing by 5.6 to $1,291. Rising one-year heifers have decreased by 4.1% to $707.

Covid-19 has not resulted in a drop in demand for dairy products with the farm gate milk price remaining very strong for the 2021 season and in the forecasts for the 2022 season. Where uncertainty remains is in relation to environmental changes, many of which have had their commencement date deferred by a year due to Covid-19. This has provided a counterweight to the increased farm gate milk price. It is likely that there will continue to be a drop in the total number of dairy cattle in New Zealand as environmental changes force a reduction in numbers. Existing production levels will likely be maintained through better genetics. As a result, we are unlikely to see a spike in values as occurred following record farm gate milk prices in the past.

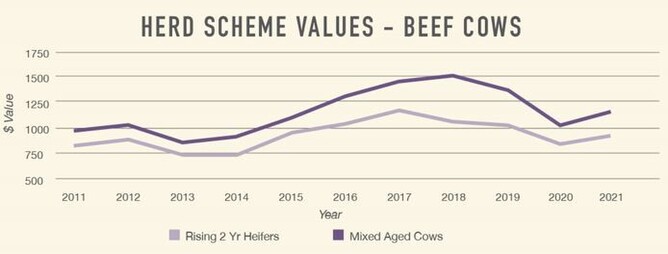

BEEF CATTLE

Beef values have recovered some of the loss in value last year but still sit below 2015 values with only modest increases across all categories except breeding bulls.

Covid-19 continues to have a significant impact on values, but increased vaccination rates will see many countries start to re-open which should result in increased demand for quality cuts as restaurants re-open and people have money to spend with travel likely to continue to be constrained for at least the next 12 months.

Uncertainty continues to play a part in the domestic market as the regulatory requirements around water quality, fencing and carbon continue to come into force in the coming years and alternative proteins continue to increase in popularity and use.

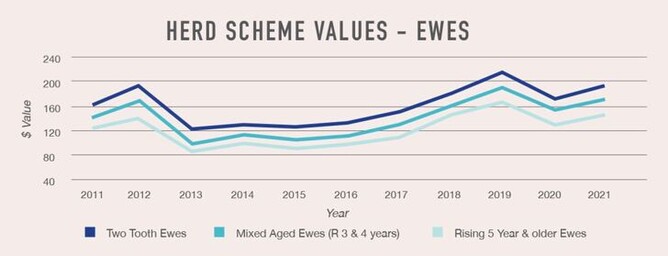

SHEEP

Like beef, sheep values have bounced back from the large drop in 2020 to return to largely what they were in the 2018 year. All categories of sheep have seen double digit increases in value except two tooth ewes and breeding rams which were the only category to decline in value. Two tooth ewes increased from $177 to $191, which equals the second highest value on record. This is consistent across almost all categories of sheep and indicates that markets have recovered well from the uncertainty posed by Covid-19 last year.

Drought has continued to be an issue in many traditional sheep farming areas with much of the upper South Island and the North Island experiencing drought conditions during the 2021 season.

Sheep numbers continue to fall, as they have done consistently since the peak of a little over 70 million in 1982, to less than 27 million now. Whilst sheep meat values have improved wool values remain depressed, including premium wool where European manufacturing has struggled to recommence following repeated Covid-19 lockdowns. As countries reopen it is likely that a new wave of demand will follow.

GOATS

Goat values have maintained much of the gains from 2020 with values being a mixed bag in the 2021 year. On average values have increased by 1.7% across all categories and breeds. The largest average gains were seen in mohair producing goats as demand for alternative fibres remains strong. Milking goat values fell on average 2.6% as demand flattened.

DEER

Deer values have been the hardest hit by Covid-19 with values of Red Deer down from between 40 and 55% since the highs of 2019. Breeding Stags are the only category where values have not suffered large losses, with values down 20% from 2019.

Other deer breeds have suffered even larger losses as the main markets for venison remained closed for much of the 2021 season. Values have just started to lift as key European and American markets slowly start to reopen as the rollout of Covid-19 vaccines gains pace.

General

Careful consideration needs to be given to your livestock election choices. Even though changes were made to the Herd scheme in recent years, there is still flexibility around how to value increases in numbers – if you increase your numbers during the year you can choose an alternative valuation option to value that increase. Whether you take that option or elect to value the increase using herd values will depend on several factors, such as:

- where we are in the cycle of livestock values (e.g. at the bottom, or at the top)

- if the increase is a permanent or a temporary one

- your longer term intentions

As the decision is clearly one that should be made on a case-by-case basis, we will naturally discuss your valuation options with you on review of your 2021 Financial Statements and Taxation Returns.